Publican’s Trade Series – Exploring How Technology, Data & Analytics Redefine Fraud Detection, Minimize Revenue Leakage & Bridge Inspection Gaps

Chapter 02 / Digital Vetting: The Technology That Unlocks Customs Collection & Tells You Exactly How Much Is Owed

Every year, customs around the world lose almost $900 billion to revenue leakages. In 2020 alone, the EU lost €93 billion, Malaysia reported RM1.5 billion missing, and Nigeria found itself last year in a N20 trillion revenue hole. That’s a pretty penny, and the reason no simple fix has appeared is because customs fraud is subtle, goods declarations can be manipulated, and insight is limited in its current framework.

Different kinds of customs fraud play a major role in causing these leaks, and there are three main areas of concern. The first is misdeclared goods, where items are wrongly declared to avoid paying the required duties, revealed by inadequate or manipulated HS codes. In 2018, an estimated $1.6 trillion in trade misinvoicing was found among 134 developing countries. Unfortunately, the mechanisms used to verify declarations still lack the visibility needed to find anomalies that serve as important tell-tale signs.

Designed to obtain lower tax rates, the undervaluation of goods is also a costly part of the equation and accounts for over half of Africa’s customs fraud, for example. Often it’s products with high duty burdens which are most vulnerable to undervaluations; some traders manipulate packaging, some declare different weights, while others evade duties by declaring similar products tied to lower tax brackets.

One area not to be overlooked is counterfeit goods, which are priced lower than their branded counterparts. This half-trillion dollar industry accounts for 3.3% of all trade, manipulating production lines and using increasingly sophisticated methods for mimicking items, creating colossal losses for governments—not just stakeholders.

Solving these challenges in revenue collection has never been more important amidst today’s economic uncertainty. Authorities are now actively exploring solutions through technology that can help them address these pain points and prevent the leakage epidemic which too often holds countries back from realizing their true potential.

DIGITAL VETTING PREVENTS LEAKAGES & TRANSFORMS REVENUE STREAMS

Publican’s Digital Vetting Technology provides customs with an entirely new approach to realizing this potential, one that allows them to address the biggest pain points of collection with billions of unique data points, full supply chain visibility, and smart new detection mechanisms that help ensure every good is fully accounted for. It also lets customs agents know exactly how much is owed in real time, presenting all misdeclared and undervalued goods, undeclared CIF values, and exact incremental incomes to be generated from each shipment.

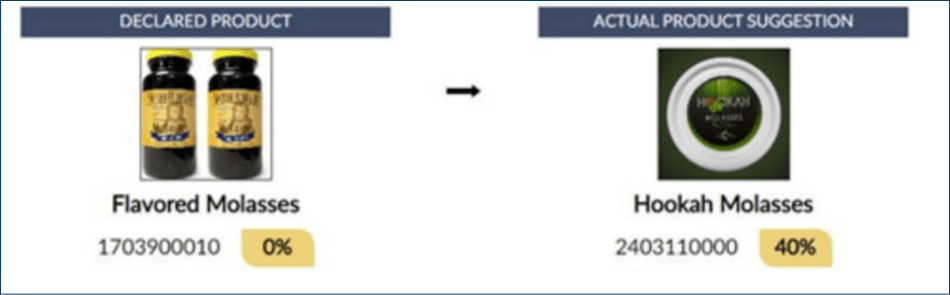

Whereas standard checks point out clear-and-obvious misdeclarations, digital vetting has the power to expose the ones that aren’t. It uses multi-dimensional analysis of tariff classifications, HS codes, and product declaration descriptions to detect anomalies that usually go unseen – discovering not only when something’s wrong but also going on to identify what exactly is right. In a recent ‘flavored molasses’ shipment, Publican analyzed adjacent tariffs of tobacco molasses vs sweetening molasses and found inconsistencies in the description & scope of business of the importer to expose a much higher-taxed ‘molasses’ used for tobacco production.

Digital Vetting also transforms our ability to detect undervaluations because it uses smart automated mechanisms that cleanse and analyze every single facet—weight, quantity, price rankings, unique keywords—connected to the value of goods. Publican showcased this in a Pulsar motorcycle shipment when it cross-checked the entire Pulsar product catalog to discover clear gaps between the declared price and true price of the bikes, before calculating the exact revenues owed.

It’s also the first technology that detects counterfeits by tracing the entire spectrum of the supply chain in real time, utilizing common fraud analysis tools and exclusive indicators that expose fakes beyond the reach of today’s checks. In a recent sewing machine shipment, it combined a smart price analysis with external local sources to uncover the importer’s illicit past (IP infringements) and discover a shipment of fakes that carried with it a high yield leakage for the authority.

Publican’s Digital Vetting is the first solution that provides authorities with the capacity to stop these endemic leakages on scale, providing full clarity into the true nature of the goods in real time, as well as codes, tariffs, and exact revenues to be accrued from each-and-every shipment. These revenues play a critical role in the economic development of a country, which is why so much has been invested into solutions that can prevent the leakages. Publican today allows customs to effectively stop the bleeding, putting countries on a new path of maximizing revenues lost to customs fraud while providing them with insight & figures every step of the way.

Get in touch

-

21 Soho Square London W1D 3QP, UK