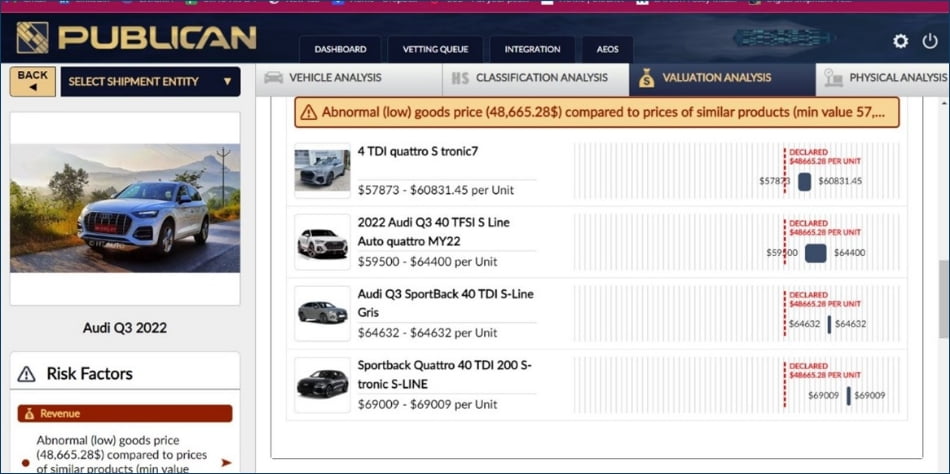

An Audi Shipment Suffering from a Severe Case of Undervaluation

A shipment heading from Western to Eastern Europe declared an “Audi” on board with a valuation of $48,665.

Findings: Publican Detected a High Risk of Misdeclaration

A shipment heading from Western to Eastern Europe declared an “Audi” on board with a valuation of $48,665. Publican Detected a High Risk of Undervaluation:

• The importer submitted an unusually generic description of simply “Audi” in the declaration, which raised some red flags because dierent models have varying rates and they did not specify the model and its corresponding price.

• The receiving Eastern European country has a 0% base tax in this case, but it also an additional import tax rate of 4% more expensive vehicles and even a higher tari in higher price brackets. and for vehicles valued any higher, the tax rate then goes up to 6-7%.

• Publican unearthed crucial evidence to discover the vehicle was not a standard Audi model (as the price declared would have implied), but actually a Q3 Sportback 40 TDI Quattro 2.0 Model, which has a listed price range of $57,873 alongside a higher connected tax rate.

How did Publican uncover this?

By conducting an in depth vehicle and valuation analysis, including the vehicle’s VIN number, Publican was able to uncover a clear case of misdeclaration.

Impact

Publican was able to create an additional 4% of the vehicle’s valuation in revenue for the Customs authority.

Get in touch

-

21 Soho Square London W1D 3QP, UK