A case of Misdeclared Molasses Heading to North Africa

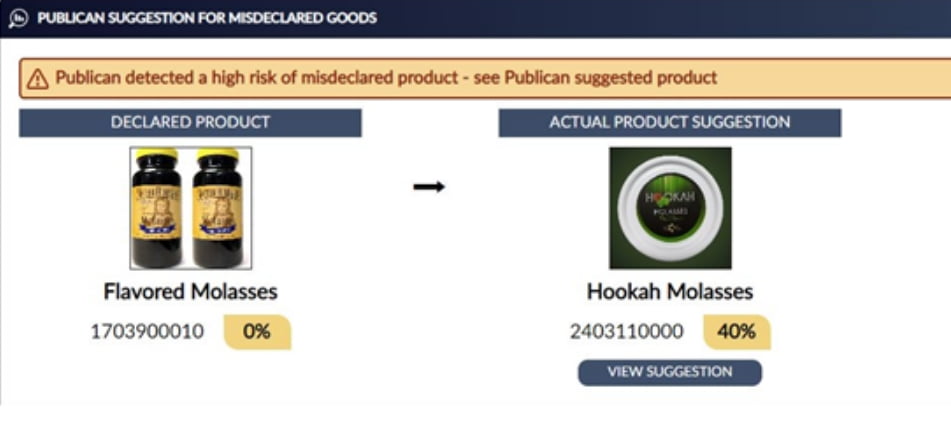

A shipment heading from the gulf to north Africa containing flavored molasses was classified under sugar and sweets (HS-217), which importers enjoy at a tariff rate of 0%.

Findings: Publican Detected a High Risk of Misdeclared Goods

• The shipper submitted an unusually generic description of “sugar and sweets” for its goods classification.

• The molasses product being shipped to the importer can be used for various commercial purposes but is most primarily used for tobacco production – a highly taxed category.

Flavored molasses used for tobacco sweetening processes currently falls under a tariff rate hovering around 40%, whereas the tariff rate connected to molasses cooking is 0%.

The importing company exclusively sells tobacco products and has no prior history of selling sugar or sweet confectionary products.

Misdeclaration

By analyzing the importer’s scope of business alongside adjacent tariffs for similar products, Publican uncovered crucial insight which pointed to the likelihood of misdeclaration.

Impact

Publican was then able to automatically recommend the North African customs authority with the correct HS codes and tariff rates for the shipment’s molasses products, alongside calculating the exact revenues to be accrued from the corrected declaration.

Get in touch

-

21 Soho Square London W1D 3QP, UK